The worldwide

leader

in travel market research

m1nd-set, founded in 2007, is the worldwide leading agency in travel research, based in Switzerland.

Our key sector of activity is travel retail, airline, and airport research & consulting.

m1nd-set has conducted over 1.500 qualitative and quantitative research studies around the world, and has successfully provided marketing intelligence to numerous Fortune 500 companies.

m1nd-set’s special strength is to provide clients with tailor-made research, analysis, actionable results and recommendations.

With airside access to over 60 airports worldwide, m1nd-set can easily reach international air travelers to conduct face-to-face interviews.

m1nd-set owns a worldwide exclusive database, which currently consists of over 1 million international travelers from 100+ nationalities, recruited at airport departure gates to conduct online interviews.

m1nd-set has conducted more than 2 Mio interviews over the last 15 years with travelers at airports, at border shops, in downtown Duty Free shops and on cruises / ferries around the globe.

Among other projects, m1nd-set runs the Airs@t survey (in partnership with IATA) which is recognized as the industry benchmark for air passenger satisfaction.

Our 150 clients

Conferences

Conferences with m1nd-set presentations

Upcoming and Recent conferences:

DFNI Annual Conference

Barcelona - 2025

CEETRA FORUM

Prague - 2025

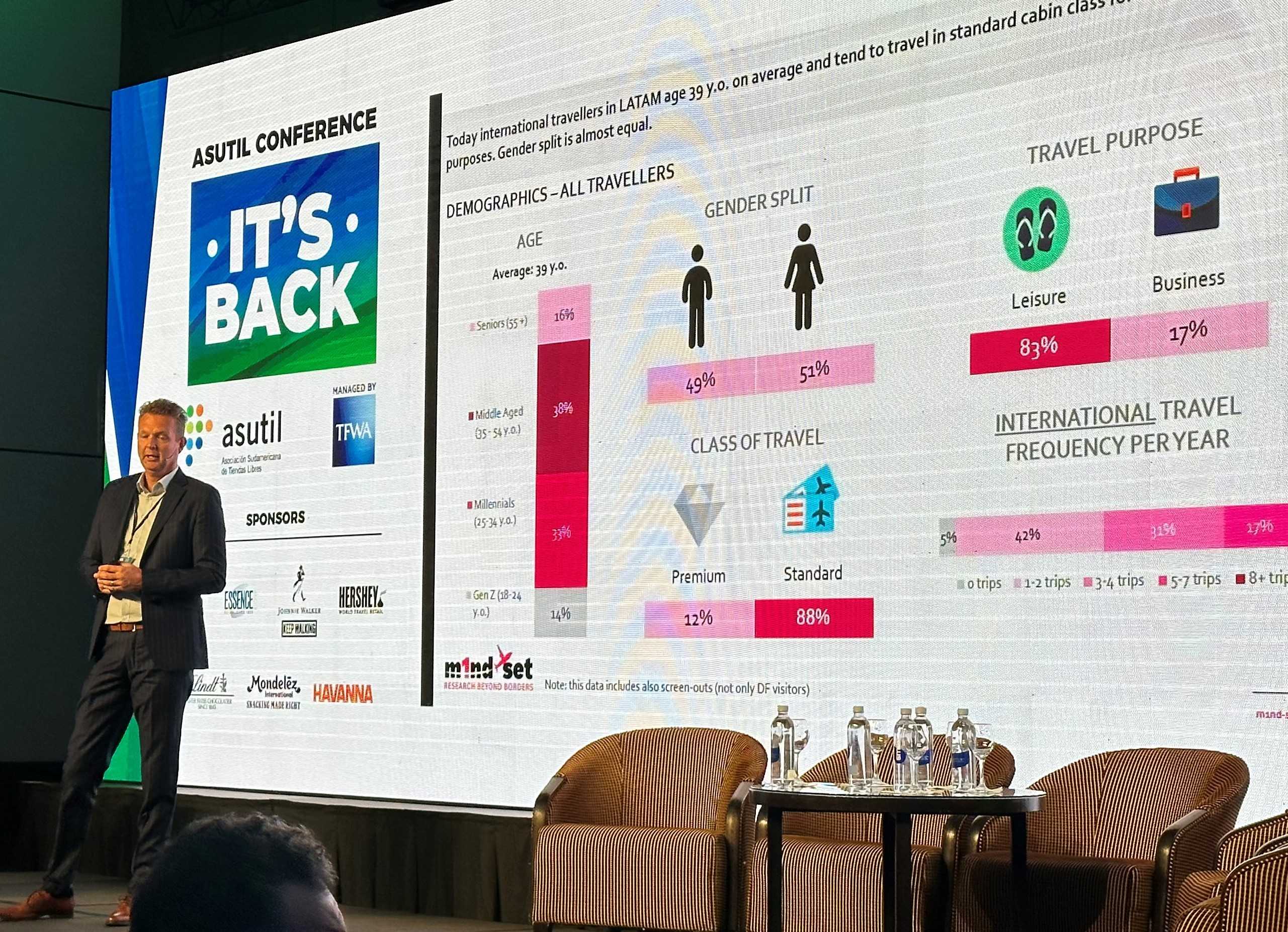

ASUTIL Latin America Conference

Lima - 2025

Travel Retail Consumer Forum

Amsterdam - 2025

TFWA Asia-Pacific Conference

Singapore - 2025

APTRA – India Conference

Mumbai - 2025

Partners

m1nd-set in the media

![]()

January 2026

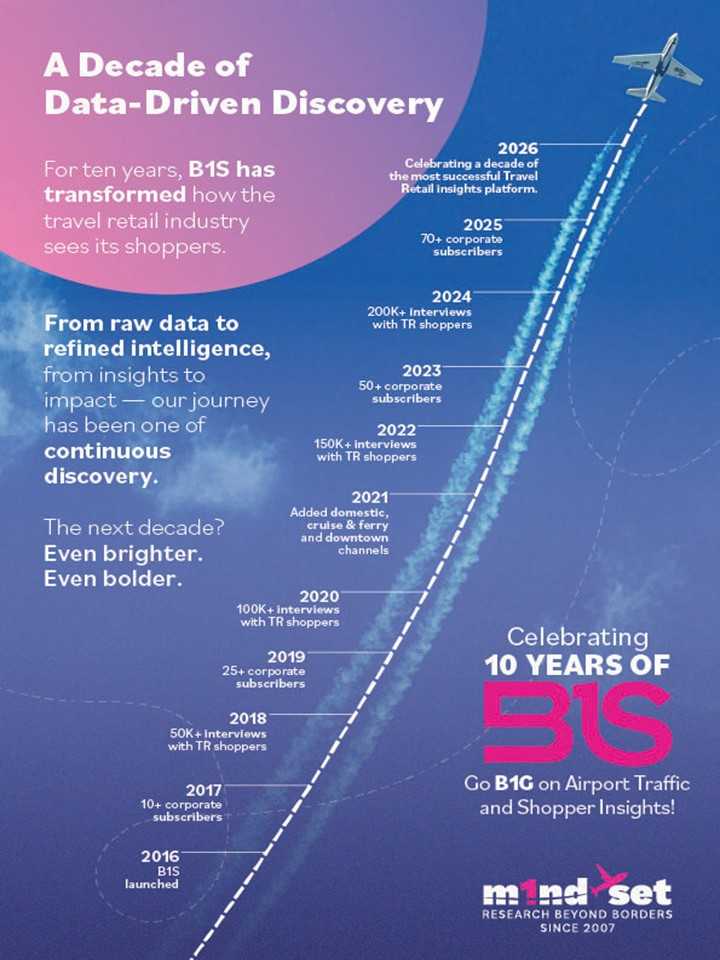

m1nd-set’s B1S Marks 10 Years as the Industry’s Leading Travel Retail Intelligence Platform

Celebrating a decade of excellence, m1nd-set marks the 10th anniversary of it’s leading product Business 1ntelligence Service (B1S), the Travel Retail & Duty Free industry’s premier marketing intelligence platform. Now a global success story with over 70 subscribers across all categories, the B1S subscription service provides 24/7 access to unparalleled insights. It delivers comprehensive data on air traffic across 1,500 airports worldwide and detailed consumer shopping behavior across airports, ferries, cruise ships, and downtown duty-free locations – all on one platform.

More on

![]()

December 2025

m1nd-set Insights Shape NITR’s Gen Z–Led Confectionery Strategy

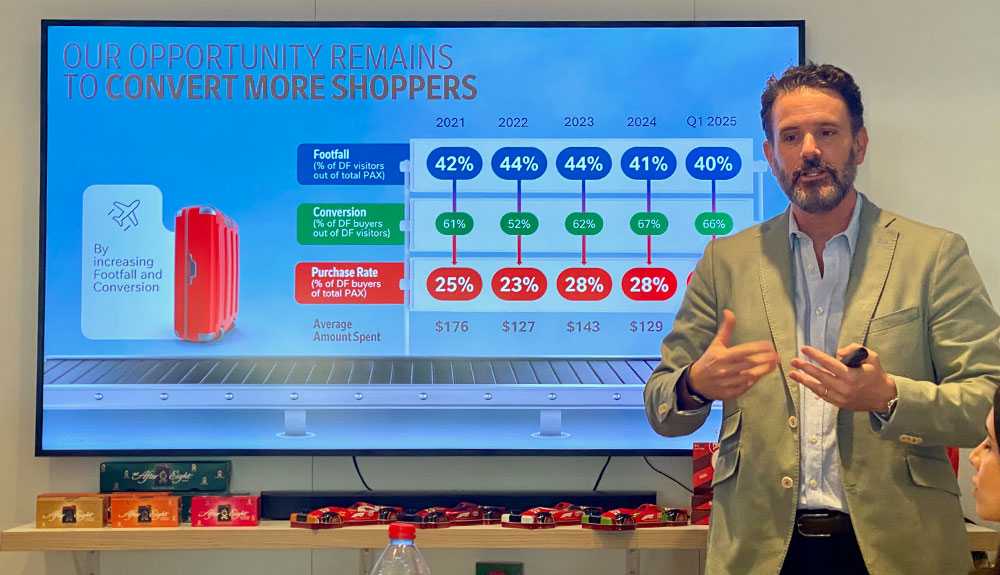

m1nd-set research underpins NITR’s strategy by quantifying the growth opportunity from rising international departures and highlighting confectionery as a stronger driver of footfall, conversion and duty-free sales. m1nd-set data shows high in-store decision-making (76%) and strong conversion potential, particularly among Gen Z, who are predominantly first-time duty-free buyers and over-index on exclusives. The insights also demonstrate Gen Z’s disproportionate propensity to purchase confectionery and adjacent categories, supporting a more targeted, Gen Z–led retail approach.

![]()

December 2025

m1nd-set contribution to EviDens de Beauté GTR Strategy

EviDenS opens the Sanya flagship, at a pivotal time for travel retail, as the channel enters a new era of wellness-driven, experience-led beauty. Across Asia, travel retail is evolving from transactional shopping to transformative experiences. Travellers seek multisensory spaces that engage emotion through storytelling, with m1nd-set data revealing that nearly half of travellers cite ‘in-store experience’ as a primary purchase driver.